The UK financial markets have experienced a significant period of volatility as the new government stamped its mark on economic policy. On Friday last week, UK Chancellor Kwasi Kwarteng announced his “Mini-Budget”, which had a substantial impact on financial markets. The media coverage has been negative and at times a little hysterical, whether it’s the mainstream or financial media. As ever, some of the criticism is justified, and some not. Below we provide some context, our view of the situation and what to expect moving forward. We will also set out our investment views on Sterling, UK Government Bonds and UK equities.

Contents:

- The “Mini-Budget” was big and bold

- UK inflation and growth set to fall in 2023

- Gilts fall sharply, but they are not alone

- Sterling takes a hit, but it is not alone

- UK equities – a lot of bad news is in the price

- Conclusion

The “Mini-Budget” Was Big And Bold

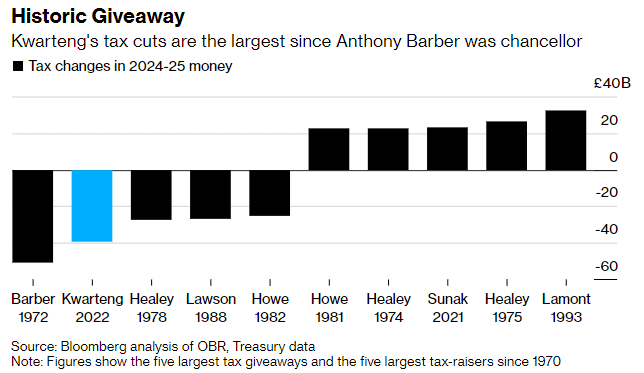

The long-awaited “Mini-Budget” was anything but, and was the 2nd largest tax cutting budget by a government in half a century (see chart below), delivering £45bn of tax cuts, equivalent to c.1.6% of GDP. This came in quick order after the necessary “Energy Price Guarantee” policy to cap the average household energy bill at £2,500. This is expected to cost the exchequer £170bn over the next 2 years.

The objective for Prime Minister Truss and Chancellor Kwarteng is for the UK economy to become a low tax, light regulation, business friendly economy, which is unsurprising from a Conservative government. It also represents a decisive deviation from current EU economic policy, signposted by the Prime Minister in her leadership contest.

However, what is concerning about it, is the attempt to resolve the issues of high energy prices, weak growth and an undefined post Brexit economic identity in a very short space of time. Collectively these plans require significant sums of money that the UK doesn’t currently have and a significant change in policy direction all occurring during a period of high uncertainty and low confidence with very little communication; limited detail and a general lack of care. The resulting spike in uncertainty hit a vulnerable bond market after its worst year on record and caused large moves in the value of both the Pound, and UK Government Bond (Gilts).

Bond markets yearn for stability, visibility and certainty and this change does not provide these things, irrespective of whether change is required or not. It is important to stress that the moves we have seen in bond yields don’t automatically mean the policies won’t be effective. It does mean that uncertainty has risen and the variability of potential outcomes, be that good or bad, has also risen, resulting in bond investors demanding a higher yield to hold a UK gilt today. Given the market response, we expect the UK Government to try to reduce this uncertainty in the coming weeks and months.

UK Inflation & Growth Set To Fall in 2023

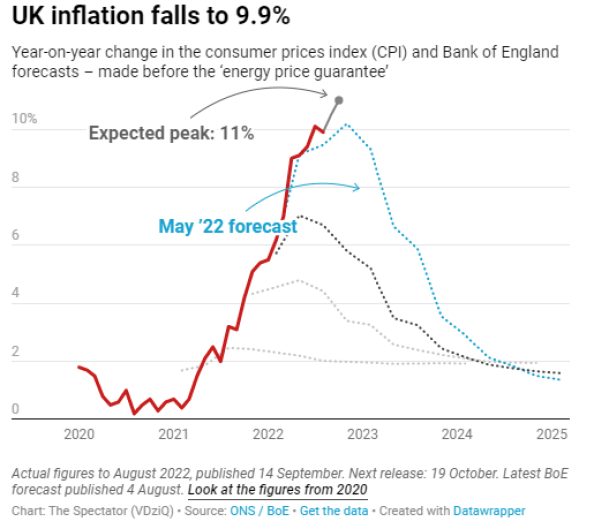

Markets partly took fright at the prospect of further fiscal expansion at a time of high inflation in the UK. The fear is that more spending will lead to higher inflation for longer. However, the latest UK Consumer Price Index (CPI) print from September fell to 9.9%, so perhaps an early sign that inflation may already be close to its peak. The adjacent chart shows Bank of England (BOE) forecasts for UK CPI, which indicates that CPI will cascade meaningfully lower in 2023, falling to 3% by the end of 2023, and falling below the BOE target rate of 2% by late 2024.

Following the Energy Price Guarantee, the Centre for Economic & Business Research (CEBR) reduced its peak CPI forecast to around 11% in October, and stated the energy price cap would take around 5% off the expected CPI inflation rate for early 2023. This is consistent with our view that we may have already seen the peak in inflation.

The BOE forecast of CPI (in blue above) was made before the Energy Price Guarantee, therefore the BOE will need to revise its projections to include a steeper fall in inflation for the early part of 2023. However, due to the increased fiscal spending in the new “Mini-Budget” the terminal rate of inflation will now be higher, perhaps in the 2-4% range, instead of the sub 2% indicated by the chart. The “Mini-Budget” is very unlikely to keep UK inflation at its current high levels, and the UK is very likely to see much lower inflation next year, however, the rate at which inflation settles is likely to be higher.

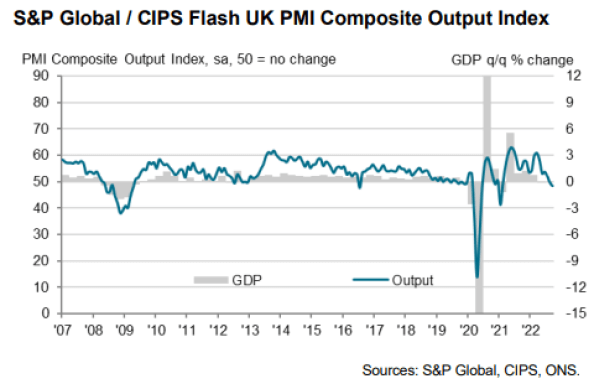

The UK economy has been slowing sharply this year as evidenced by the Purchasing Manager Indices (PMIs) falling from highs of over 60, to below 50 in recent months. These are large business surveys that are widely used as lead indicators for GDP growth. Any reading below 50 indicates a contraction in growth.

Gilts Fall Sharply, But They Are Not Alone

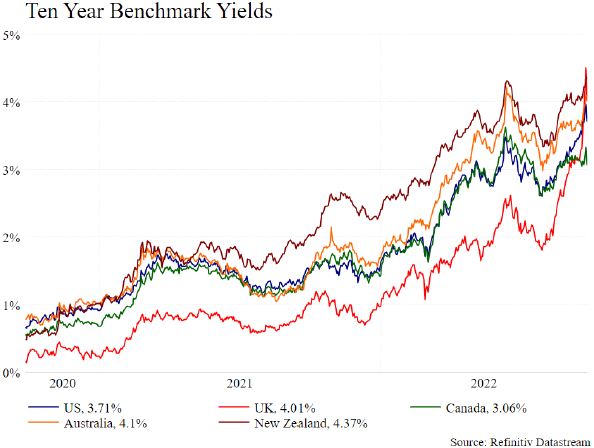

We have seen a meaningful negative repricing in Gilts (UK Government Bonds), reflecting the higher borrowing expected to be required to fund the recent policy announcements as well as the increased uncertainty, and a lack of confidence in the new PM and Chancellor. 10-year Gilt yields have moved from c.0.96% to c.4.1% over the course of the year so far, resulting in a historically large capital value loss of around 30%.

At current levels though, Gilts offer an attractive yield, particularly relative to other Developed Markets. For example, equivalent government bond yields are 3.7% on the US Treasury, 2.15% on the German Bund, 2.7% on the French OAT and 0.25% in Japan.

As a result, relative to these other developed markets, Gilt investors are now being rewarded with a higher income yield as well as more potential downside protection should yields begin to fall again. In fact, during recessionary periods, and periods of falling inflation, that is exactly what we would expect to see.

This chart shows how the 10-year Government Bond Yield has moved across various developed markets over the past two years. It shows that rising yields have been a feature of all these developed markets for some time now and the same upward trend has also occurred in Europe and Japan.

Developed market bond yields actually bottomed in the middle of 2020, and have been rising ever since. More recently, the UK yield has moved to a comparable level with higher growth developed economies such as Australia, Canada, New Zealand and the US.

There is no denying that the new Government is responsible for the most recent sharp spike higher in the UK yield, but it is against a broad backdrop of rising developed market government bond yields. Core developed markets have seen their 10-year government bond yields rise by an average of 2.2% this year, with the UK Gilt experiencing a slightly sharper rise of 3.1% over the same period. There is also a perception right now that a low yield is a sign of strength. We would argue, rather, that it is a sign of stability and safety, but not necessarily economic prowess. Japanese Government Bonds for example, have had exceptionally low yields for decades. Japan is financially secure, but nominal economic growth is low.

Sterling Takes A Hit, But It Is Not Alone

Currencies have been a major talking point this year and some have hit major milestones. The Japanese Yen hit a 24 year low against the US dollar, the Euro sank to (and subsequently past) parity with the US Dollar for the first time in 20 years, and now it is Sterling in the hot seat. Again, the most recent bout of weakness for Sterling was in response to the “Mini-Budget”, however the common thread between the broader price action for these three currencies is the other side of the trade – and that is the strength of the US dollar (USD).

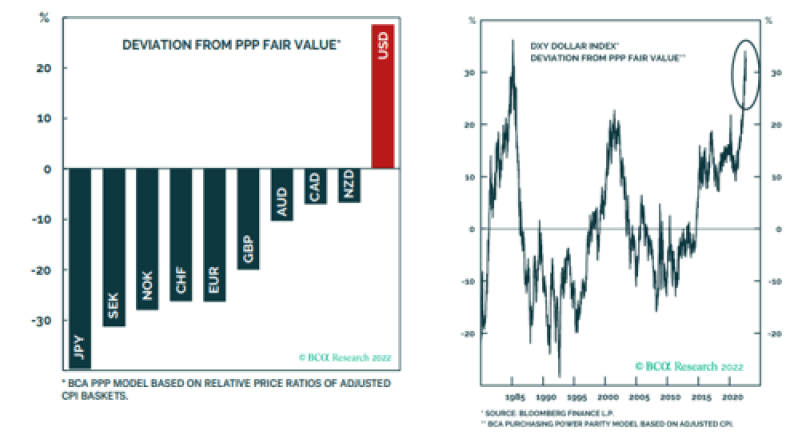

The charts above highlight the extreme valuation of the USD. The charts are based on a measure called

“Purchasing Power Parity” (PPP). This is a commonly used measure of the purchasing power of a currency, calculated using the cost of a common basket of goods in each country. The charts show whether current prices look expensive, or cheap relative to the level suggested by PPP. As you can see, on this measure, the USD is close to 30% overvalued and most of that has occurred this year.

It hasn’t been as strong as this, since the 1980s. Conversely, the Yen (JPY), Euro (EUR) and Sterling

(GBP) are currently between 20-40% undervalued on a PPP basis.

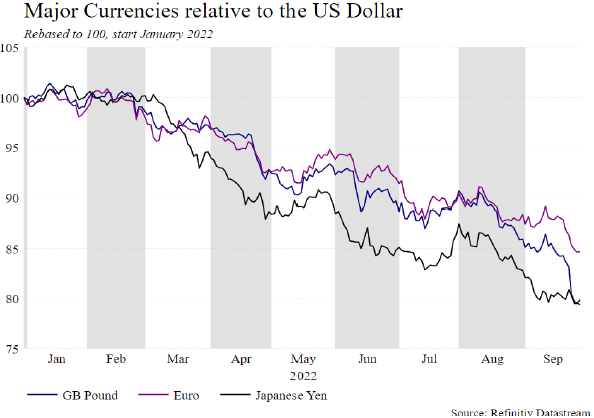

The USD is the global reserve currency and has appreciated meaningfully, which is often the case when market sentiment and confidence is weak. GBP has not been immune to this USD appreciation and has fallen with the Yen and Euro.

The chart above shows how EUR, GBP and YEN have performed since the start of this year, relative to the USD. It shows that these three major currencies have all fallen 15%, 20% and 22% respectively. It is clear that global macro factors are exerting significant downward pressure on these currencies.

The Chancellor’s “Mini-Budget” has given GBP an extra leg down, but the negative trend had been in place for some time and is not a purely UK phenomenon.

UK Equities – A Lot Of Bad News Is In The Price

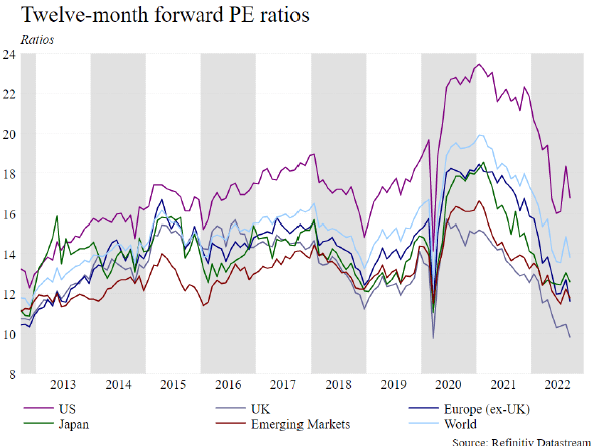

As UK based investors the UK equity market is a very important allocation in client portfolios and today, the UK is attractively priced relative to its own history. UK equities trade on a multiple of c.10x forward profits, meaning that it costs £10 to buy a £1 of UK annual corporate profits, which is low relative to its historical range of £12-14 per £1 of profits. How this “Price to Earnings” (PE) valuation multiple has changed over time for various regional stock markets, is shown in the chart below.

From these low valuation levels, combined with a cheap currency, there is a meaningful return opportunity for UK equities going forwards, particularly relative to other more expensive regions, with expensive currencies, such as the US.

Poor market sentiment, weak growth and high inflation have pushed investors into the safety of the USD, however eventually we will move to a more bullish phase which we believe could be as early as the first half of next year. This will place significant downward pressure on the USD given its high starting valuation today.

UK companies will benefit from the cancellation of the increase in corporate tax from 19% to 25% as it will increase their profitability. Also, many of the UK’s large and mid-sized companies are globally exposed with revenues from the US, Europe and Asia, and these will benefit from a weaker GBP in the short term.

Conclusion

There is no denying that it has been very tough period for UK assets, and in particular Gilts and Pound Sterling. The timing and manner of the announcement of the “Mini-Budget” has been handled terribly. However we would caution against the doomsayers. Cutting income taxes, reducing the tax burden on companies, reducing tax on property purchases and reducing regulations are all stimulative to economic growth. This is stimulus that may be needed soon, given the backdrop of slowing economic growth, tightening monetary conditions, and our belief that inflation is peaking and could fall significantly in the coming months.

Feedback from the markets has been unequivocal. The lack of communication, transparency and guidance around these new policies were the key drivers behind the market moves. This, combined with the actions been taken by a new, untested and inexperienced Prime Minister and Chancellor during a period of weak market sentiment has compounded the problem. Confidence in the new policy is rock bottom, however, it can be addressed and we will likely see a determined effort from the Government to do so in the coming days and weeks.

From here we expect substantially more communication from the Government towards the City, global banks and large institutional investors and detailed analysis of how these policies will be funded and why they will be successful. We also expect more announcements on deregulation.

We expect action from the BOE in the form of interest rate hikes to provide support to Sterling. They have already intervened in markets to support the pension fund industry who have suffered as a result of the move higher in yields dramatically altering their funding positions with a lack of time to prepare for the new policies.

The UK has had multiple crises in recent years, resulting in downward pressure on the value of UK assets. From these levels, we now have an attractively priced bond market and currency to complement the cheap equity market. Despite the inevitable near term volatility, we believe there are strong returns to be had in UK assets over the long-term for the patient investor.

To discuss your investment strategy please contact your Chase de Vere financial adviser. Alternatively, if you’ve not dealt with us before, you can request to speak to one of our advisers here.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.