House prices rose by around 10% in 2021 – their fastest pace in 15 years – but that is no guarantee of what may come in 2022. Relying on bricks and mortar to boost your finances may no longer be as attractive as it once was.

Source: Nationwide.

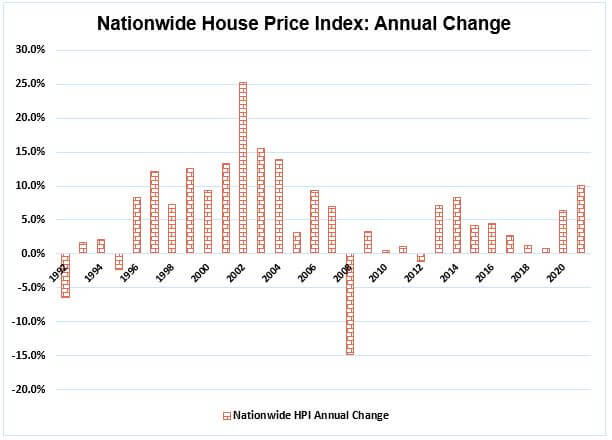

Just as inflation enjoyed an unexpected leap in 2021, so too did house prices. According to Nationwide, the average UK home rose in value by 10.4%, while Halifax put the increase at 9.8%. As the graph shows, it was the sharpest rise in house prices since 2004 although, as ever, the UK average figure hid significant regional differences. At the bottom rung of the property ladder, Halifax says that London prices rose by 4.2% – below inflation – while at the top, Wales saw prices rise by 15.8%. Nevertheless, the average London home still costs more than two and a half times its Welsh counterpart.

Last year’s increase in house prices appears to have been driven by two inter-related factors:

- The Covid-19 pandemic driven increase in working from home stimulated a desire for more space – inside and out – that encouraged many people to move; and

- Temporary and, it now appears potentially unnecessary, cuts in stamp duty gave a boost to the housing market, with transactions brought forward to gain savings of up to £15,000.

In 2022, there are some obvious headwinds:

- Interest rates are on the rise, adding to mortgage bills;

- The pandemic effects, including full-time working from home, look set to wain;

- There is a looming cost-of-living squeeze, as inflation heads upwards and earnings are hit by tax increases; and

- 2021’s increases mean property is 10% dearer than a year ago.

In mid-January 2022, the government added a small additional obstacle by confirming a change to council tax rules on holiday homes. From April 2023, holiday homes will be liable to council tax (rather than the more favourable small business rates regime) unless they are let for at least 70 days during the previous year.

The change – a significant cost increase for some second homeowners – is only the latest in a series of measures over recent years that have increased the tax burden on investment in residential property. The UK public has long had a love affair with bricks and mortar – as testified by a quick perusal of TV listings – but as a personal investment, it is no longer the tax haven it once was. If you want a holiday home, you may be better off investing your capital elsewhere and using the income generated to pay for a fortnight’s Airbnb wherever the whim takes you. After all, you may well already own enough residential property in the form of your own home.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Tax laws can change. The Financial Conduct Authority does not regulate tax or benefit advice.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.