The US stock market set a new record for the longest-ever bull market in August.

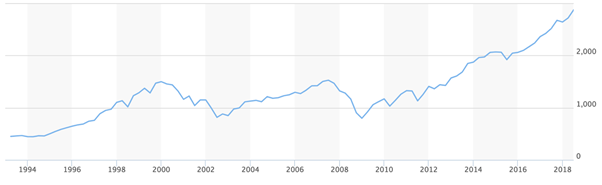

S&P 500 Index Performance

Wednesday 22 August 2019 saw the S&P 500 drop – by less than 0.1% – after 3,453 days, making it the longest-ever bull run (a period of rising share prices) for the index, which is used by professional investors’ as a yardstick for the US stock market.

The previous record was set between 1990 and 2000, a period that saw the dot-com boom, followed shortly after the start of the new millennium by the tech bust.

The current rally has been helped by a strong performance from technology stocks, notably the ‘FAANGs’ (Facebook, Apple, Amazon, Netflix and Google (now called Alphabet)). It has also been aided by a period of ultra-low interest – the US Federal Reserve’s main rate was set to a historic low in December 2008 and did not rise above 1% until June 2017. In the last year US companies have also benefitted from Donald Trump’s corporate tax cuts, which have boosted earnings figures.

Despite the record performance, this bull market has been labelled as “the most hated of all time”. Throughout, sceptics have viewed the market as trading on borrowed time and reliant on the easy-money policy of the US central bank. How much longer the rally can last remains a hot topic.

While interest rates are now rising the US economy is growing strongly, and that is working its way through to the bottom line of the now more lightly-taxed US companies. Similarly, while the S&P 500 index is regularly reaching new peaks, other measures of valuation show US shares much less highly valued compared to previous market peaks.

Whatever the future holds, the past near nine and a half years have provided a reminder of the wisdom of international diversification of investments.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at time of writing and is intended for general information only and should not be construed as advice.