2021 ended with inflation sitting at 5.4%, but it may not have felt like that to you.

Source: Office for National Statistics.

You may have caught the food campaigner Jack Monroe on TV and radio interviews recently highlighting how the uneven effects of inflation on the most basic foodstuffs can have a disproportionate effect on lower income groups. Her intervention has prompted the ONS to look beyond the average in more detail at ‘individual inflation rates’.

Annual CPI inflation in the UK for 2021 was 5.4%, a sharp increase from a year earlier, when it was just 0.6%. The jump, which took the inflation measure to its highest level in almost 30 years, was by no means unique to the UK. Across 2021, in the US, inflation rose from 1.4% to 7.0% while in the Eurozone the change was from –0.3% to +5.0%.

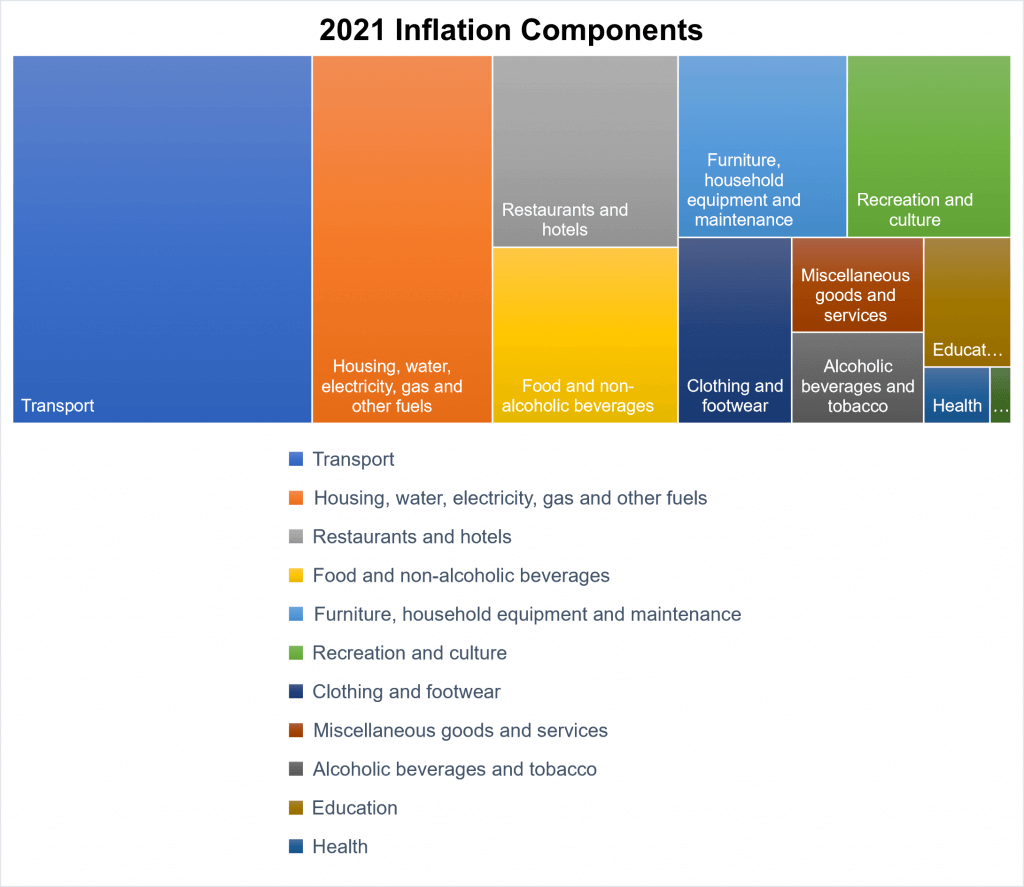

Whether inflation felt like 5.4% to you is another matter. The hierarchy chart above shows how the dozen price categories that make up the CPI contributed to that headline inflation figure. The standout sector, accounting for nearly a third of overall inflation, was transport. Drill down into that and you will find three sub-sectors with annual inflation exceeding 25%: fuel and lubricants; second-hand cars and air flights. If you did not buy a second-hand car and did not fly in 2021 – as many people did not – then two of those three passed you by.

The second largest inflation driver was what might be described as the home sector – housing, water, electricity, gas and other fuels. It was those last three that were the main problem, with household fuel bills rising by 22.7%. If you were lucky enough to have a fixed-term contract for your utilities – and your supplier survived 2021 – then again, the change recorded by the CPI statisticians would have been irrelevant to you. On the other hand, if your bargain fixed-term deal (or its supplier) ended in 2021, then your utility bills might have risen much more than implied by the CPI.

The lesson to learn from all this data is that inflation as measured by the CPI is unlikely to be the inflation that you experience. Your mix of spending probably does not match the CPI ‘shopping basket’ and will change over your lifetime. For example, in retirement, expenditure on commuting will generally disappear but outlays on recreation activities may well increase.

Your financial planning should always take account of inflation. The unexpected jump in 2021, and expectation of further increases in 2022, could mean that it needs to be reviewed – either based on the CPI or your personal circumstances.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.