The world’s share markets had a rollercoaster ride in 2020.

Investors had to hold on tight as 2020 turned into a white-knuckle experience.

It began quietly enough and then in the second half of February global stock markets took on the concern at the spread of Covid-19. As infection rates increased and the economic outlook darkened, there were precipitous falls in all the major markets. A sense of panic was in the air, not helped in the UK by two base rate cuts within the space of a fortnight. Then, just about the time the UK formally went into lockdown on 23 March, around the world market sentiment turned sharply. After something of a sideways drift during the summer, November saw a further boost to confidence from the news on the Pfizer/BioNTech vaccine.

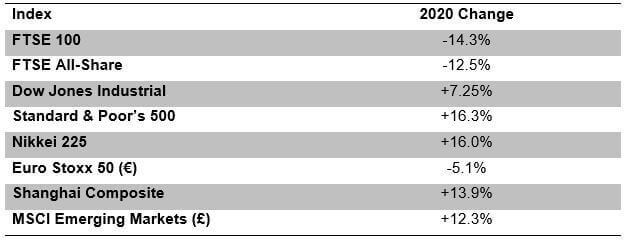

By the end of the year, the US, Japanese and Chinese stock markets were all recording overall gains – a far cry from the picture in March. As the table above shows, the UK market was a laggard in 2020. The have been many explanations for that – the FTSE 100’s heavy weighting in banks (which stopped paying dividends) and oil majors (which slashed their payouts) are obvious culprits. So too were the uncertainties of the Brexit finale and the government’s handling of the pandemic.

On the opposite side of the Atlantic, the US government Covid-19 response was hardly any more impressive, but the US markets benefited from their exposure to technology companies: we were all Zooming, Googling and buying from Amazon.

There are a few useful lessons to draw from 2020:

- It is all but impossible to achieve perfect timing for making an investment. That March sentiment flip seemingly came from nowhere.

- Those who cashed in at the peak of the panic chose the worse time to sell up. Once again, the advice to sit tight proved correct.

- International diversification is important for UK-based investors. The UK may host many large multinational companies but, like Europe, it lacks exposure to technology giants.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.