The planned increase in corporation tax has changed some of the mathematics on incorporation.

The Budget announced a significant change to corporation tax from 2023:

- Small companies, with profits of up to £50,000, would continue to pay the tax at the current rate of 19%, subject to adjustments for associated companies and financial periods of other than 12 months.

- Large companies with profits of over £250,000 will pay corporation tax at a rate of 25%.

- For companies whose profits fall between £50,000 and £250,000 HMRC have said that there will be “marginal relief provisions”, which have now been set out in the Finance Bill. As under previous corporation tax regimes, the marginal relief is given by applying the lower rate up to the small companies limit and then applying a higher than standard marginal rate to profits above that threshold. With the new rates from 2023, the £200,000 band of profits above £50,000 will suffer a marginal tax rate of 26.5%.

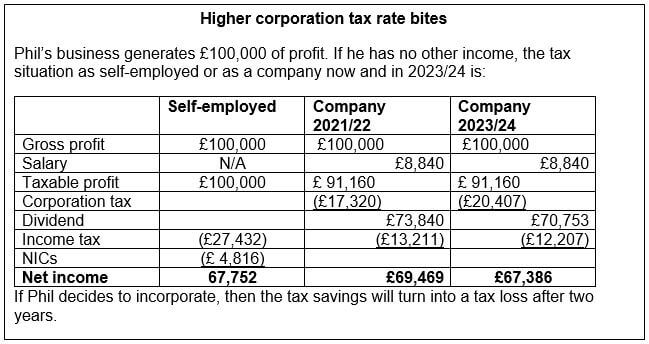

At present, from a tax viewpoint, it can be better to run a business via a company rather than on a self-employed basis. This is mainly because a company will allow the bulk of earnings to be received as dividends, thereby avoiding national insurance contributions (NICs). While this approach will still work for businesses with profits that would attract only the 19% small companies’ rate, it is a different picture for higher profits, as the example below shows.

The decision on business structure should never be made based on tax alone as there are many other factors involved. However, the deferred tax changes announced in the Budget may tip the scales for some. As ever, advice based on your personal – and business – circumstances is essential.

The value of tax reliefs depends on your individual circumstances. Tax laws can change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.