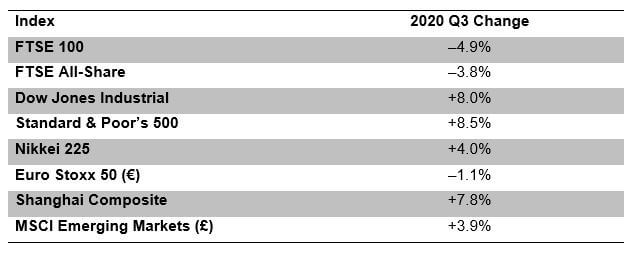

The third quarter of 2020 saw share markets calmer than in the previous two.

For many, 2020 has not been a year they will want to remember. For investors, the first two quarters were a whiplash experience. For about a month from mid-February, Covid-19 pushed share markets down with a brutal abruptness. By the time March came to an end, there was a consensus that, as often happens, the gloom had gone too far. As a result, the second quarter produced rises across the major markets. In the summer, it looked like the worst of the pandemic could be over and the forecasts of a V-shaped recovery would prove correct.

The third quarter, and in particular September, provided a different story. The threat of a second wave of Covid-19 emerged, while two other longstanding ‘known unknowns’ – the US presidential election and the end of the Brexit transition period – came closer into sight. Central banks’ talk of multi-year zero or sub-zero interest rates did not encourage investors, perhaps suspicious that 12 years after the global financial crisis, the rate setters had finally run out of monetary ammunition.

The UK stock market’s third quarter was weaker than in other major markets. In global terms, it is arguable that the UK looks cheap – the historic price-earnings ratio for the UK market is around 21 compared with 29 in the US. However, across the Atlantic, the main market index, the S&P 500, rose by 8% in the third quarter against a fall in the FTSE 100 of 5%. Once more, the US market has been driven by the five technology giants – Microsoft, Apple, Amazon, Facebook and Alphabet (aka Google) – which account for 1% of the number of companies in the S&P 500 Index, but almost 23% of the by value.

The third quarter was generally more rewarding for investors in overseas markets. The fourth quarter’s impending US election and Brexit finale looks set to create a dramatic end to a dramatic year. What 2020 has proved yet again is that market timing is virtually impossible, so if you think now is the time to act – whether buying or selling – make sure to take advice before pulling the trigger.

The value of your investment and income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at time of writing and is intended for general information only and should not be construed as advice.