Dividends paid by overseas companies fell less sharply than their UK counterparts in the second quarter of the year.

Source: Janus Henderson

The impact of the Covid-19 pandemic on corporate dividends has been dramatic in the UK. Total dividend payments from quoted companies fell by over half in the second quarter, according to research published in July by Link Asset Services. However, the picture is rather different on a global scale, as other research published in August by Janus Henderson (JH) revealed.

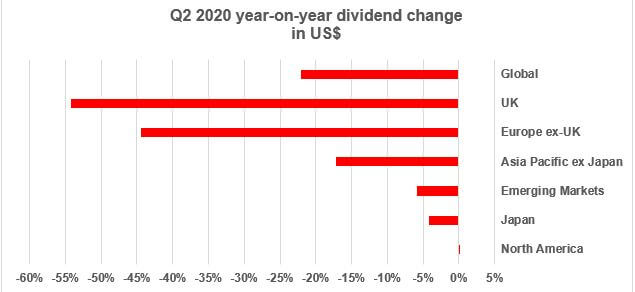

The JH report showed that overall dividends (in US$ terms) fell by 22% between the second quarter of 2019 and the same period in 2020. As the graph shows, the UK as a geographic region came bottom of the pile by a wide margin. In individual country terms the UK was not the worst affected – both France (-65%) and Spain (-70%) suffered larger dividend cuts. The Europe ex-UK region was supported by Germany, which saw dividends drop by 23%.

Japan, where companies have traditionally paid out a low proportion of their profits as dividends, fared well, benefiting from that conservative financial approach. 80% of the Japanese companies covered in the JH research either held or increased their dividends.

As shown on the graph, North America (US and Canada) produced miniscule dividend growth. This needs to be treated with caution as USA Inc goes its own way with dividends. Typically, US companies set their dividends once a year and pay them in four equal instalments, beginning with the fourth quarter. As a result, most of USA Inc is paying out dividends decided in the pre-Covid-19 era. The impact of the pandemic will arrive in the fourth quarter of 2020, when the next four quarters of dividends are set.

Funds investing in the UK have often been the first port of call for investors wanting share-based income. Partly this has been because the UK stock market has had a higher dividend yield than most overseas markets. The JH global dividend figures are a reminder that non-UK sources of dividend income should not be ignored: as ever, diversification of investments can make sound investment sense. Fortunately, there is now a wide choice of overseas equity income funds to choose from, covering global, regional and single country markets, but be sure to seek advice before committing.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at time of writing and is intended for general information only and should not be construed as advice.