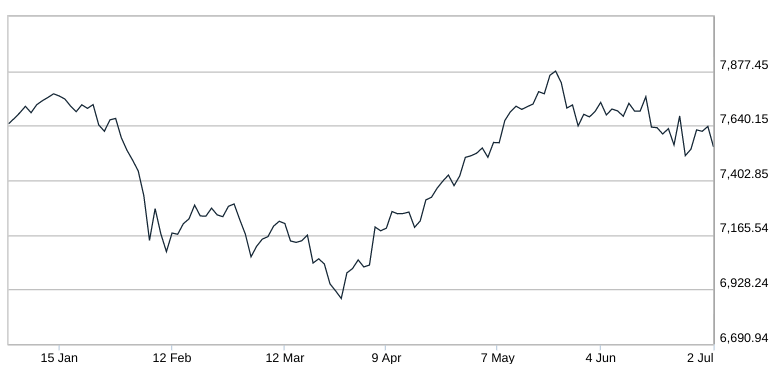

The first six months of 2018 were unpredictable times for investors as global stock markets suffered a sudden bout of volatility.

Source: LSE

The unpredictability came as a major surprise after the general stability of 2017. Once the dust had settled there was a mixture of good and bad news.

The UK markets were inevitably led by Brexit, with negotiations mainly at the intra- rather than inter-government level. The other perennial British topic, the weather, produced the Beast from the East, depressing economic activity in the first quarter.

US short term interest rates continued to rise under the new chairperson of the Federal Reserve, with more increases promised for the second half of the year. Meanwhile, the tension between America and North Korea turned into a denuclearisation agreement and the Trump tax cuts were followed by the start of Trump trade wars, hitting long-term allies as well as the supposed target of China.

For all that, an investor who opened their first newspaper of the year on 1 July 2018 would have thought nothing much had happened. The FTSE 100 index fell by less than 1% in the first six months of 2018. Across the Atlantic, the S&P 500 rose in the same period, but only by 1.7%.

The small overall changes are a reminder that daily market movements often turn out to be self-cancelling noise, best ignored by the long-term investor.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Content correct at time of writing and is intended for general information only and should not be construed as advice.