The Value of your NHS Pension vs Private Pensions

There’s a groundswell of opinion in the medical community that paying into the NHS pension “isn’t worth it”.

It used to be that having a great pension was one of the best things about working for the NHS. What changed? In the effort to safeguard the future NHS pension:

- Doctors have been asked to pay more in, up to 14.5% of earnings for some, and even more for GP employers, who have to pay the employers’ contribution as well

- Many expect to retire later, at age 68

- The payout is less generous with the switch to a career average scheme

Together, with repeated cuts in the tax relief on what can be paid into [and accrued in] your NHS pension, it paints a rather gloomy picture, but gloomy enough to opt-out of the NHS Pension Scheme?

There’s a saying that “you have to take the bad with the good”, and the reality is that the good far outweighs the bad for the vast majority of NHS Pension Scheme members, even if it is sometimes hard to see.

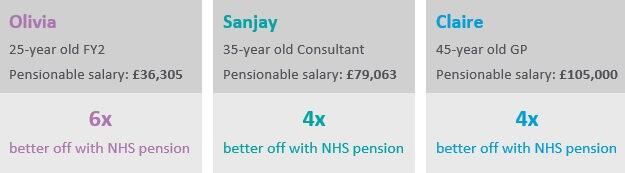

The below examples illustrate how the NHS pension compares with a private pension.

Examples

Olivia

Olivia is a 25-year-old FY2. She has a pensionable salary of £36,305.

Over a year Olivia contributes £3,376 from her salary into her NHS pension, which will give her a guaranteed, inflation-linked, pension income of £672 per annum when she retires. Please note, this represents annual income that will be received from a year of contributions only. However, this annual income will increase for every year that Olivia contributes to her NHS pension, eventually amassing a sufficient pension income entitlement to achieve her retirement goals.

If Olivia saved into a private pension rather than the NHS Scheme, based on an annuity rate of 3.257%, to provide the same annual pension income (£672 per annum) she would need to contribute £20,642 from her salary … over 6 times more!! ¹

Sanjay

Sanjay is a 35-year-old consultant. He has a pensionable salary of £79,063.

Over a year Sanjay contributes £10,674 from his salary into his NHS pension, which will give him a guaranteed, inflation-linked, pension income of £1,464 per annum when he retires. Please note, this represents annual income that will be received from a year of contributions only. However, this annual income will increase for every year that Sanjay contributes to his NHS pension, eventually amassing a sufficient pension income entitlement to achieve his retirement goals.

If Sanjay saved into a private pension rather than the NHS scheme, based on an annuity rate of 3.257%, to provide the same annual pension income (£1,464 per annum) he would need to contribute £44,953 from his salary … over 4 times more!!¹

Claire

Claire is a 45-year-old GP². She has a pensionable salary of £105,000.

Over a year Claire contributes £14,175 from her salary into her NHS pension, which will give her a guaranteed, inflation-linked, pension income of £1,944 per annum when she retires. Please note, this represents annual income that will be received from a year of contributions only. However, this annual income will increase for every year that Claire contributes to her NHS pension, eventually amassing a sufficient pension income entitlement to achieve her retirement goals.

If Claire saved into a private pension rather than the NHS scheme, based on an annuity rate of 3.162%, to provide the same annual pension income (£1,944 per annum) she would need to contribute £61,494 from her salary … over 4 times more!!¹

When comparing the NHS Pension Scheme vs private pensions, the difference is glaring, largely thanks to the fact that as a member of the NHS pension, you benefit from employer contributions – currently 14.38%³ annually of your pensionable earnings – compared to an average of 3.2%4 in the private sector.

Scheme holders also benefit from:

- Life cover

- Financial support for your dependants should you die

- Guaranteed income for life, which increases to keep pace with rising living costs

On the question of value then, while today’s doctors, younger doctors especially, arguably aren’t on as good a deal as their predecessors, the NHS pension, unequivocally, still offers excellent value for money, certainly when compared to “going it alone” with a private pension – and for every doctor, the NHS pension is the main pillar of their retirement planning.

Need NHS pension advice? Get in touch with Chase de Vere Medical.

As specialists they can give you an independent, expert view on your NHS pension options, and if you’re considering it, they can advise you on whether opting out is the right strategy for you. BMA members can take advantage of an initial free no-obligation consultation.

¹We have assumed that the personal pension will achieve net growth equal to the guaranteed increase in the NHS scheme (CPI + 1.5%) and that CPI will be 2%

²Does not include employer contributions

³This figure is 14.9% in Scotland and 16.3% in Northern Ireland

4Office for National Statistics, Occupational Pension Schemes Survey: UK, 2016. Release date: 28 September 2017

Content correct at time of writing and is intended for general information only and should not be construed as advice.