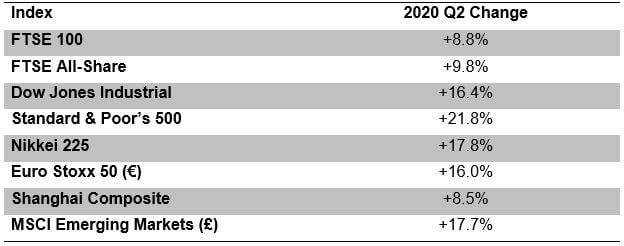

The second quarter of 2020 saw a substantial switch back from the falls of the first quarter.

2020 so far has been a rollercoaster ride for investors. It started off well enough, but in the middle of February, Covid-19 prompted a rout that took markets deeply into the red by the end of the first quarter. Although it was not obvious at the time, by then the world’s central banks had in fact taken enough action to encourage a market recovery in the second quarter of the year.

There is a point to watch when looking at these quarterly numbers: contrary to what we might think, the rules of mathematics mean that a fall of 20% is not cancelled out by a subsequent rise of 20%. In fact, what is needed is a 25% rise (100 x 80% x 125% = 100). So the momentum of the second quarter has left even the best performers, such as the US S&P 500 index, marginally below where they began 2020.

The UK’s second quarter recovery was not as strong as many other major markets. That could reflect the relatively poor performance in dealing with the pandemic, the UK indices heavy weighting to banks and oil majors (neither popular) and their lack of technology companies. Across the Atlantic, it is the technology shares which have been the biggest drivers of market performance – Microsoft, Apple, Amazon, Facebook and Alphabet (Google’s parent company) are now the five largest companies in the S&P 500.

The bounce back in the second quarter is a reminder that trying to time investment can be a futile exercise. With hindsight – but only with hindsight – it is easy to spot that selling in early January and buying towards the end of March was the way to a fortune. If you lack such perfect vision, then the lesson so far in 2020 has been that volatility works in both directions. In such circumstances, it pays to take advice before taking an action.

The value of your investment, and the income from it, can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at time of writing and is intended for general information only and should not be construed as advice.